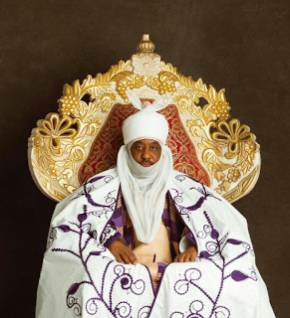

Former governor of Central Bank ofNigeria, CBN and Emir of Kano, His Royal Highness, Sanusi Lamido Sanusi, said weekend, he was ready for probe of his tenure in the apex bank, following allegations byLagos lawyer, Mr. Femi Falana, SAN, that he diverted government funds.Sanusi’s declaration came on a dayhis predecessor, Mr. Charles Soludo, described as blataAnt lies, Falana’s allegations that he unlawfully diverted $7 billion of thecountry’s reserves as loans to banks.The human rights lawyer had called on the Economic and Financial Crimes Commission, EFCC, to probe both former governors of the apex bank over the allegations.Falana’s allegation“Sometime in 2006, former Central Bank Governor, Professor Chukwuma Soludo, removed $7 billion from the nation’s external reserves and doled it out to 14 Nigerian banks. Two years later, the Central Bank Governor, Mallam Sanusi Lamido Sanusi (the current Emir of Kano), also gave a bailout of N600 billion to the same banks.‘’The request of some civil society organisations for the recovery of the huge loan of $7 billion and N600 billion from the commercial banks has been ignored by the management of the Central Bank.Emir of Kano, HRH Muhammadu Sanusi II“In the Appropriation Act, 2011, the sum of N245 billion was earmarked for fuel subsidy. In violation of the Act, the CBN headed by Mallam Sanusi Lamido Sanusi, paid the sum of N2.5 trillionto a cabal of fuel

importers.‘’Following our petition, the EFCC conducted an investigation into the fraud but the exercise was compromised due to pressure from the former Jonathan administration. Even though the EFCC has charged some of the suspects to court, theinvestigation ought to be reopened with a view to getting to the root of the monumental fraud,” Falana alleged in a statement on Saturday.But reacting to the allegations, Sanusi said he was always available to answer questions regarding his stewardship at the Central Bank.On fuel subsidy, he said: “The Central Bank does not pay and has never paid subsidy tomarketers and the only circumstance this would happen is the Central Bank acting asbanker to government and carrying out instructions to make payments from government accounts.“There is absolutely no circumstance underwhich the CBN would have disbursed its own money for payment of subsidy or disbursed money on behalf of government without authorization.”He said the CBN was in the “forefront of the effort to expose the corruption in the subsidy regime and put a stop to it.”Sanusi respondsSanusi, who described the allegation on bank bailouts as strange, said: “The moneywas not given to bank shareholders and management but was provided to ensure that ordinary Nigerians and other depositors who kept their money in banks did not lose their savings as a result of the mismanagement of these banks and bad loans.“The money remains a loan to those banks and is to be repaid from a combination of sources over the years. These include sale of collateral backing non-performing loans held by AMCON, recovery of those loans, sale of share of the banks held by AMCON and a sinking fund into which all banks are to make annual contributions.“This will continue no matter how long it takes until the banking industry repays all amounts due to AMCON and the bondholders are repaid.“All of this is in line with the law setting up AMCON and the purpose of setting it up in the first place.“The resolution of the Nigerian banking crisis and the AMCON model are actually being held up as an example of how to deal with severe and systemic banking crisis. Not a single depositor in any Nigerian bank lost a single kobo due precisely to these arrangements.”Soludo hits back at FalanaIn his reaction, Sanusi’s predecessor as CBN governor, Charles Soludo, hit back at Falana, dismissing his allegation as “ignorant” and “blatant lies”, and demanded evidence or an apology.“I largely ignore such ignorant commentaries. However, Femi Falana is one of the Nigerians I deeply respect, and I am sure many Nigerians also hold him in very high esteem. I was, therefore, shocked beyond belief that someone like him could fabricate and peddle blatant lies,” Soludo said in a statement he issued, weekend.Soludo, who left the CBN in 2009, said throughout his tenure, Nigeria never lost one penny of the reserves.He said said one of the legacies of his tenure as CBN governor was the highest rate of reserve accumulation in Nigeria’s history as well as its effective and efficientmanagement.“On assumption of office, I met exactly $10billion in foreign reserves. With average monthly oil price of $59 during my tenure, we accumulated reserves to all time high of over $62 billion. Even after paying off Nigeria’s external debt with $12 billion and facing unprecedented global financial and economic crisis, I still left $45 billion upon leaving office in 2009,” he said.“Throughout my tenure, Nigeria never lost one penny of the reserves. It is particularly important to note that even during the global financial crisis of 2008/2009 when major international banks collapsed and some countries lost some of their reserves, our prudent management ensured that Nigeria never lost a penny butearned returns on the reserves.‘’Given the powerful interests that I fought during the consolidation of banks and evensince I left office, one can only imagine the international headlines that would have been made if just one penny of the reserves was unaccounted for.“That under the provisions of the CBN Act as well as the guidelines for the management of foreign reserves, it is impossible for anyone to ‘remove’ any sumof money from the reserves and give out as “loan” to commercial banks in Nigeria.‘’To qualify as ‘foreign reserves’ such reserves are held in foreign currency abroad as deposits with banks or in sovereign instruments such as the US treasury bills,” he said.Soludo said he would be ready at any time to respond to any questions regarding his stewardship at the CBN.

No comments:

Post a Comment